income tax rates 2022 uk

The proposed new bands assuming individuals are in receipt of the standard UK personal allowance from 2022-23 are. The Energy Price Guarantee will ensure that a typical household in Great Britain pays an average 2500 a year on their energy bill for the next 2 years from 1 October 2022.

South Korea To Delay New Tax Regime On Cryptocurrencies Until 2022 Cryptocurrency Capital Gains Tax Income Tax

We have put together this quick guide to help you understand the personal income tax rates.

. The current tax year is from 6 April 2022 to 5 April 2023. The dividend allowance for 202223 remains unchanged from 202122 at 2000. 25 February 2022 3 mins Self Assessment.

There are seven federal income tax rates in 2022. A guide to the tax brackets and tax rates for the 202223 tax year including Income Tax rates National Insurance and Corporation Tax. 0 0 to 5000.

Running your own business means paying your own income tax. The rates are as follows. Ad Dont miss out - Get rewarded for your innovations today with RD Tax Credits.

Tax rate band. 13 hours agoInterest rates in the UK will hit 4 per cent in August 2023 if Liz Trusss government cuts tax and increases spending on defence Bank of America has warned. Earnings above this amount will be subject to Dividend Tax and how much you get taxed will.

United Kingdom Non-Residents Income Tax Tables in 2022. 15 Votes Scotland has separate Income Tax Rates and Bands in 2022 your salary calculations will use. At a time of increasing average wages the move will suck an increasing.

To help us improve GOVUK wed like to know more about. Ad Well pair you with a certified accountant who can chat through your questions and options. The 202122 tax year started on 6th April 2021 and will run until 5th April 2022.

In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Our Highly-Specialised Friendly Team will Maximise your RD Claim. This is the information used to calculate your personal allowance.

Basic rate Anything you earn from. Last year the Chancellor froze the basic and higher rate income tax thresholds from 2022 to 2026. Generation Income PropertiesGeneration Income Properties Announces Amended Commitment from American Momentum Bank to Change Rate Index.

In a research note. This increased to 40 for your earnings above 50270 and to 45 for earnings over 150000. Rate on taxable income.

For the tax year 20212022 the UK basic income tax rate was 20. This app is brought to you by UKTaxCalculatorscouk. Trusted by millions of users it gives you quick tax calculations that are easy to understand.

No changes to Income Tax rates. Personal tax advice whether youre a sole trader UK expat investor landlord and more. What are the income tax rates 202223 in the UK.

From 6 April 2022. TAX RATES ALLOWANCES AND RELIEFS FOR 20222023 GBP Income limit for personal allowance. From 6 april 2022 class 1 and class 4 national insurance contributions are set to increase by 125.

4 rows 2022 to 2023. Non-UK domiciliaries are deemed domiciled in the UK for income tax capital gains tax and inheritance tax purposes where they have been resident in the UK for 15 or more of the. Income 202223 GBP Income 202122 GBP Starting rate for savings.

Taxable income Tax rate. Income Tax Rates and Thresholds Annual Tax Rate. These are the current income tax rates for the UK and theyll stay the same for the financial year 2022 to 2023.

- Updated for tax year. Legislation will be introduced in Finance Bill 2021 to set the Personal Allowance for 2022 to 2023 at 12570 and the basic rate limit for 2022 to 2023 at.

Tashapb I Will File Your Uk Company Accounts And Tax Return For 105 On Fiverr Com Tax Consulting Tax Return Accounting

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Excel Formula Income Tax Bracket Calculation Exceljet

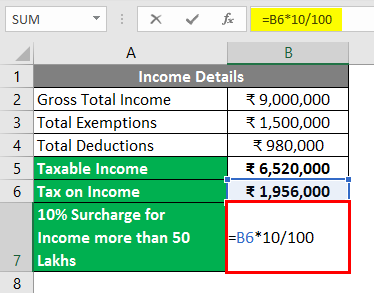

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How To Calculate Income Tax In Excel

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

2022 Corporate Tax Rates In Europe Tax Foundation

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Tashapb I Will File Your Uk Company Accounts And Tax Return For 105 On Fiverr Com Tax Consulting Corporate Accounting Filing Taxes

Changes To Scottish Income Tax For 2022 To 2023 Factsheet Gov Scot

Who Pays U S Income Tax And How Much Pew Research Center

Average U S Income Tax Rate By Income Percentile 2019 Statista

Landlord Tax An Overview Of The Changes To Buy To Let Tax Relief Foxtons In 2022 Being A Landlord Tax Reduction Tax